Bayside Notes

Investment opportunities in our renewable unsecured subordinated notes program

Key Features

- • $50,000 minimum investment

- • Terms from 3 months to 5 years

- • Daily compounding interest

- • Flexible payment schedule options

- • No fees or commissions

Current Rates

| Term | Rate |

|---|---|

| 3 Months | 6.50% |

| 6 Months | 7.50% |

| 1 Year | 8.50% |

| 2 Years | 10.00% |

| 5 Years | 11.25% |

Rates effective as of August 27, 2025

Contact Us

For more information about our investment program:

Phone:

877-254-9409

Email:

Current Investment Opportunities

Current Investment Opportunity

Log in to View

Please log in to view our current investment opportunities, or request access below.

Don't have access?

About Bayside Credit

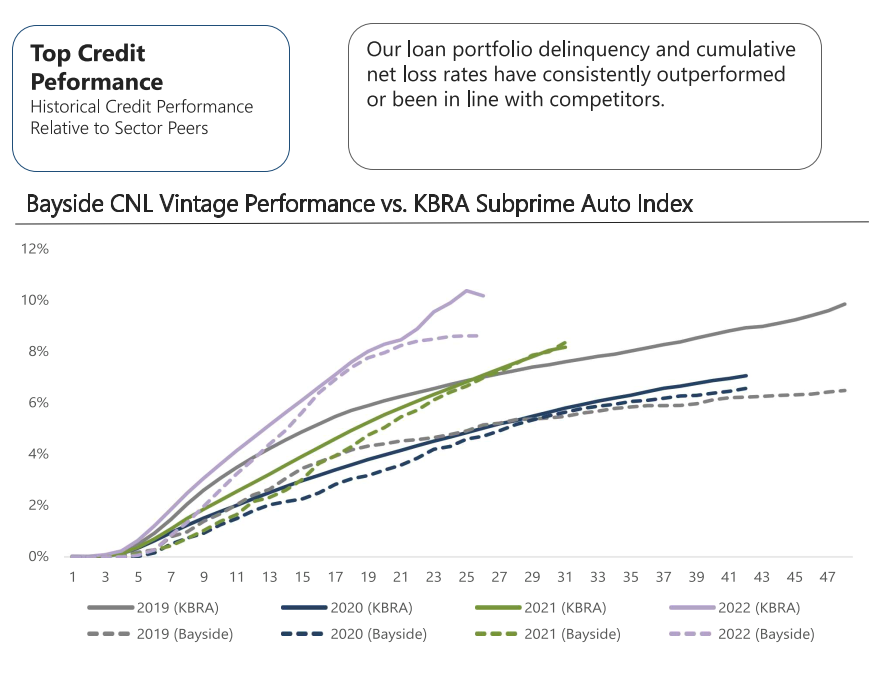

Bayside Credit is a specialty automotive finance company focused on providing financing solutions for consumers through a nationwide network of dealers.

Company Overview

- Founded in 2015

- Headquartered in Orange County, California

- Privately held company

- Over $200MM in loans originated

Investment Risks

Investments in our notes program involve certain risks. Notes are not FDIC-insured and are unsecured subordinated debt obligations. Please read our private placement memorandum carefully before investing.

This is not an offer to sell or solicitation of an offer to buy our notes. Such an offer may only be made by means of a private placement memorandum. Investments in our notes involve certain risks. Notes are not FDIC-insured. Please read the private placement memorandum carefully before investing.